Britannia Industries, Limited - A Sweet Long Term Investment Opportunity

Company History

Britannia Industries Limited is a leading Indian food company that manufactures and sells a range of products such as biscuits, bread, cakes, and dairy products.

Source: TheBrandsofIndia.com

In the early years of Britannia's history, the company was known as Britannia Biscuits Co. Ltd. and was founded in Kolkata, India in 1892. The company gradually expanded its product range and reach. Britannia went public in 1918 and listed on the Bombay Stock Exchange (BSE).

During the 1960s and 1970s, Britannia faced tough competition from other biscuit manufacturers and struggled with declining profits. In 1975, the company entered into a joint venture with the French group Groupe Danone to introduce new products and technology. This partnership helped Britannia to revive its business and regain market share.

In the 1990s, Britannia started to diversify its product portfolio by introducing new products such as bread and cakes. The company also expanded its reach by setting up new manufacturing facilities and distribution networks across India.

In 2000, Danone sold its stake in Britannia, and the company became a wholly-owned subsidiary of the Wadia Group. Since then, Britannia has focused on consolidating its position in the Indian market and expanding its presence overseas. The company has also introduced new products and acquired brands such as Milk Bikis, Tiger, and Good Day. The company has a strong presence in the biscuit segment and is a market leader in several categories such as cream biscuits, crackers, and glucose biscuits.

As of April 25, 2023, the company has a market capitalization of RS1.06T.

Strong, Experienced Management Team

Britannia has a highly experienced and capable management team with a track record of driving growth and profitability. The current Managing Director of the company is Varun Berry, who has been with the company since 2013. Before joining Britannia, he was the CEO of PepsiCo Foods, Vietnam, and has held various senior leadership roles in PepsiCo over a career spanning more than 25 years.

The company's board of directors includes several industry veterans with decades of experience in various fields such as finance, marketing, and operations. The board is led by Nusli Wadia, who has been associated with Britannia for more than 40 years and has played a pivotal role in the company's growth and success.

Under the leadership of its management team, Britannia has consistently delivered strong financial performance and has maintained its dominant position in the Indian food industry. The management team has focused on expanding the company's distribution reach, introducing new products, and improving operational efficiency to drive growth and profitability.

The management team has also demonstrated a commitment to sustainability and social responsibility. The company has implemented several initiatives to reduce its environmental footprint and has undertaken several CSR projects to improve the lives of the communities it operates in.

Overall, Britannia's management team has a deep understanding of the Indian food industry and has demonstrated the ability to drive growth and profitability while maintaining a strong focus on sustainability and social responsibility.

Strong Moat

Britannia Industries has a strong moat to maintain its market position and profitability over the long term, which is reflected in its dominant position in the Indian food industry.

Source: Analyst Presentation dated February 2, 2023

Britannia's moat is based on several factors, including the following:

Brand Strength: Britannia has a strong brand presence and is one of the most recognized brands in India. The company has been in business for over 130 years and has built a strong reputation for quality, taste, and innovation. The Britannia brand is associated with trust and reliability, and this has helped the company to maintain a loyal customer base.

Distribution Network: Britannia has an extensive distribution network that covers both urban and rural areas in India. The company has over 5,000 distributors and 250,000 retail outlets, which helps it to reach a large customer base. The distribution network is a significant barrier to entry for competitors, as it is difficult for new entrants to replicate Britannia's reach.

Product Portfolio: Britannia has a diversified product portfolio that includes biscuits, bread, cakes, and dairy products. The diversified product portfolio helps Britannia to mitigate risks and capitalize on opportunities in different segments of the food industry.

Innovation: Britannia has a strong focus on innovation and has a dedicated research and development team. The company continuously introduces new products and flavors to cater to changing consumer preferences. This helps Britannia to differentiate itself from competitors and maintain its market share.

Overall, Britannia's moat is based on its strong brand presence, extensive distribution network, diversified product portfolio, and focus on innovation. These factors give the company a sustainable competitive advantage, which helps it to maintain its market position and profitability over the long term.

Risks to Consider

As with any investment, there are risks associated with investing in Britannia. Some of the risks that investors should consider before investing in the company include the following:

Competition: Britannia operates in a highly competitive market, and there are several domestic and international companies that compete with it. The competition may intensify, which could result in a decline in the company's market share and profitability.

Raw Material Costs: Britannia uses several raw materials in its manufacturing process, such as wheat, sugar, and oil. The prices of these raw materials are subject to fluctuations, which could impact the company's profitability.

Regulatory Risks: The food industry is subject to various regulations and quality standards. Any changes in regulations or quality standards could impact the company's operations and profitability.

Economic Conditions: The demand for Britannia's products is dependent on the overall economic conditions in India. Any downturn in the economy could impact the company's sales and profitability.

Foreign Exchange Risks: Britannia exports its products to several countries and is exposed to foreign exchange risks. Fluctuations in exchange rates could impact the company's revenue and profitability.

Supply Chain Risks: Britannia relies on a network of suppliers and distributors to manufacture and distribute its products. Any disruptions in the supply chain could impact the company's operations and profitability.

Competition

Britannia Industries Limited faces intense competition in the Indian food industry from both domestic and international players. Here are some of the major competitors of Britannia in India:

Parle: Parle is one of the largest biscuit manufacturers in India and has a strong presence in the mass-market segment. Parle's product portfolio includes popular brands such as Parle-G, Monaco, and KrackJack.

ITC: ITC Limited is a diversified conglomerate with a strong presence in the Indian food industry. The company's biscuit portfolio includes brands such as Sunfeast and Dark Fantasy, which are popular in the premium segment.

Mondelez International: Mondelez International is a global food company that has a significant presence in India's biscuit market. The company's biscuit brands include Oreo, Cadbury, and Digestive.

Patanjali Ayurved: Patanjali Ayurved is a rapidly growing Indian consumer goods company that has been expanding its presence in the food industry. The company's biscuit portfolio includes brands such as Atta Biscuit and Marie Biscuit.

To stay competitive, Britannia has been focusing on innovation, product development, and expanding its distribution reach. The company has been investing in research and development to introduce new products that cater to evolving consumer preferences. Britannia has also been expanding its distribution reach, particularly in rural areas, to increase its market share.

Britannia's strong brand equity and reputation for quality also help it to maintain a competitive edge in the market. The company has been investing in marketing and advertising to strengthen its brand and increase consumer awareness.

Overall, the Indian food industry is highly competitive, and Britannia will need to continue to focus on innovation, cost management, and expanding its distribution reach to stay ahead of the competition and maintain its market leadership.

Historical Financial Results

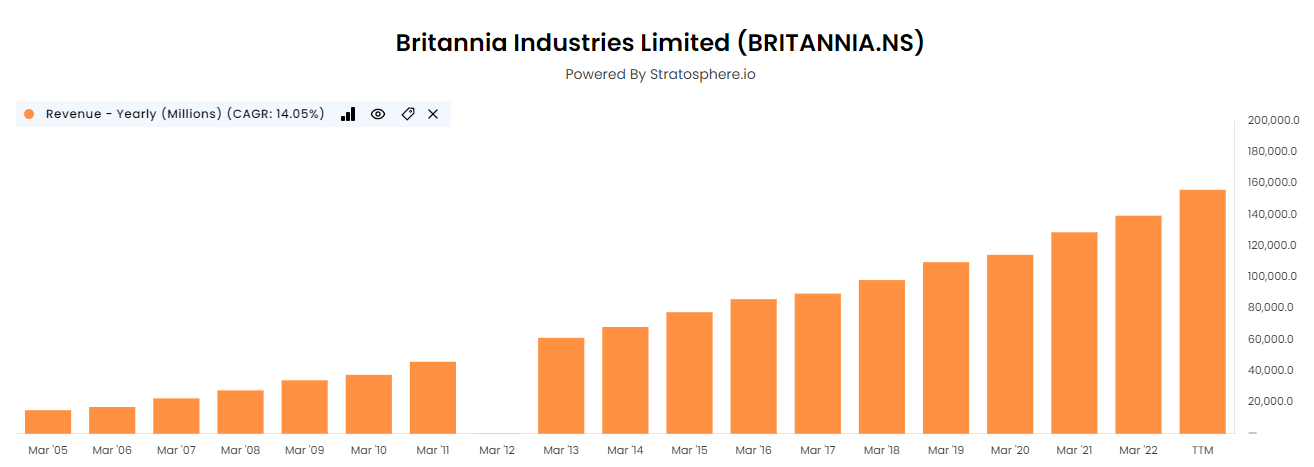

Revenues have appreciated with a CAGR of more than 14% since 2005.

Source: Stratosphere.io

Over the last 17 years, gross profit margins have varied between 30 and 40% and are currently at almost 39%.

Source: Stratosphere.io

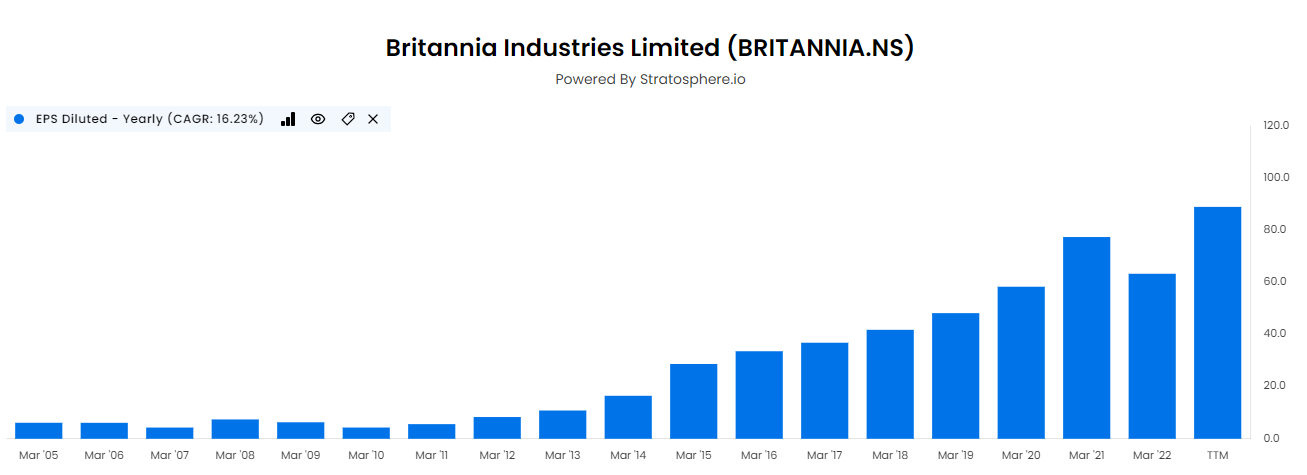

This resulted in earnings per share increasing at a CAGR of more than 16% since 2005.

Source: Stratosphere.io

Free cash flow margins have been positive since 2009 and are slowly trending upwards to 5.3% now.

Source: Tikr.com

Returns on invested capital have been spectacular over the years, ranging between18 and 405% and ROIC is currently at 77%.

Source: Stratosphere.io

Valuation

Britannia’s stock price has appreciated with a total CAGR of more than 25% since 1996.

Source: Stratosphere.io

Although EPS has been consistently growing, the PE ratio has dipped to about 58 vs. an average of 48.3.

Source: Screener.in

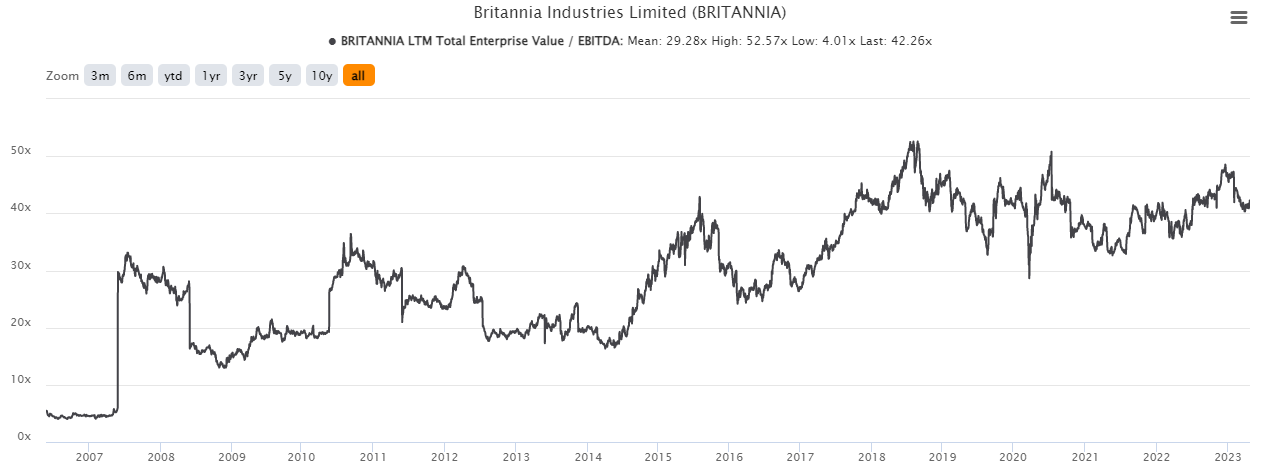

The LTM Total Enterprise Value / EBITDA ratio has been steadily rising and is now at 42 vs. mean of 29.

Source: Tikr.com

According to Stratosphere.io the stock’s PEG is 1.22, while Screener.in has it as 5.1.

The dividend yield is currently 1.6%.

On the last earnings call, Vice Chairman and Managing Director, Mr. Varun Berry mentioned “from a revenue growth standpoint, it clearly is indicative that even the entire industry is growing at double digit revenue.” India's food industry is expected to grow significantly over the next decade, driven by rising disposable incomes, changing consumer preferences, and increasing urbanization. Britannia is well-positioned to benefit from this growth, given its strong brand and distribution network. The company has been investing in expanding its distribution reach and improving operational efficiency, which should help it capture a larger market share and improve profitability.

Having said that, though the stock price looks expensive at these levels and I would wait until it dropped to levels where the EV/EBITDA ratio is at least equal to the mean.